What is HS Code or customs tariff?

HS code or customs tariff of goods

Commodity tariff code is used as a classification system for goods to determine the customs tariff applicable to each good. This code is usually determined by the World Customs Organization (WCO) and is known as the Harmonized System of Commodity Description and Coding (HS Code).

First of all, it is better to provide you with some information about the World Customs Organization, WCO. WCO, which is the World Customs Organization, was established in Belgium and its activity is to develop international trade relations and agreements. This organization has the task of classifying all kinds of goods, fighting counterfeit goods trade to protect property rights, supply chain, international customs facilities, etc. Countries that are members of the World Customs Organization all use the customs tariff code system.

Hs code : Harmonized System Code

The HS Code was created in 1988 by the World Customs Organization (WCO) and has been widely used around the world ever since. The system is regularly updated to adapt to changes in international trade and new technologies. The commodity tariff code is very important in determining the customs tariff. By using this code, you can determine the customs tariff for each product, and in this way, you can calculate the cost of importing goods. It is known as a common language for international trade.

In general, HS Code is very important in international trade. Using this system, goods can be accurately and uniformly classified, and thus customs fees and other trade-related costs can be calculated.

The structure of the commodity tariff code (hs code)

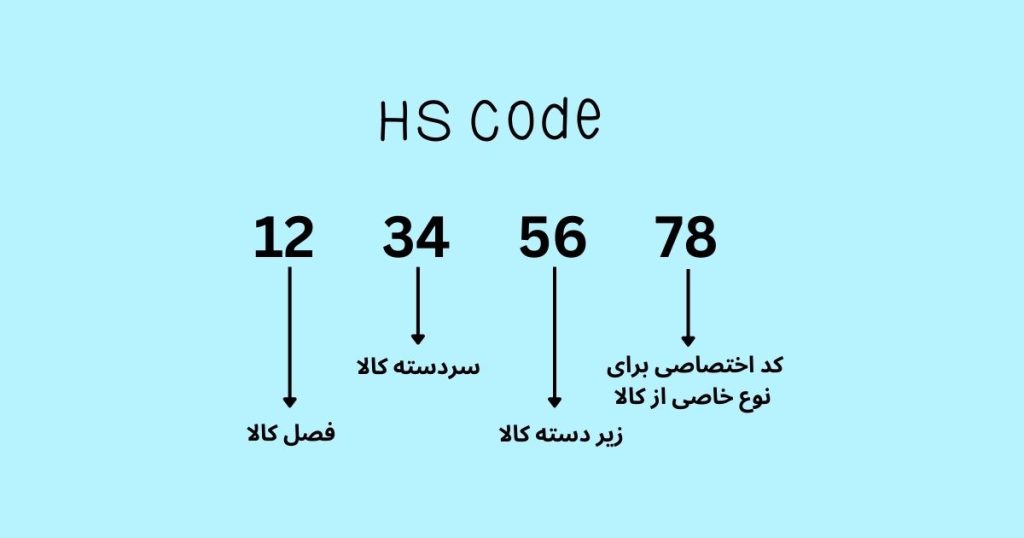

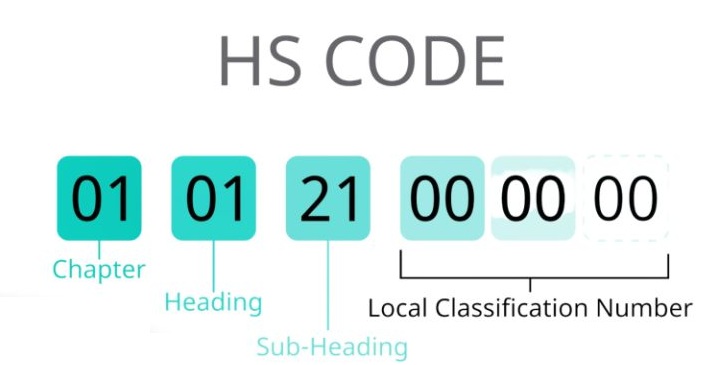

The commodity tariff code consists of 6 to 10 digits, which in Iran is specified as 8 digits, which is as follows:

- The first two digits: Section

- Second two digits: Chapter

- The third four digits: Product group (Heading)

- The fourth two digits: Subheading

- The fifth two digits: Tariff item

Example of tariff code

For example, the tariff code for an industrial machinery may be as follows:

8431.10.00.00

which in this example:

84: Goods department (machinery and equipment)

43: Goods season (industrial machinery)

1: Product group (special industrial machines)

10: Product subgroup (special industrial machines for metal production)

00: Product subgroup (special industrial machinery for the production of ferrous metals)

Why was Hs code or customs tariff code specified for goods?

In every country, a book is published every year to determine the customs tariff code of goods, in which, in addition to the customs tariff, the duties and customs duties of each product are mentioned, you can by preparing this book in physical or digital form or its compact disc Iran is also printed, find out about the customs tariff code of the product you want. Therefore, you don’t need to learn the customs tariff codes of different goods;

HS Code is determined on what basis?

This code is determined based on the name of the product, its use, the ingredients of the product and its type of use. In the process of determining the HS code, the following factors are considered:

The physical and chemical characteristics of the goods, such as size, weight, shape and ingredients, play a role in determining the HS code.

To recognize the HS code, it is necessary to identify the use of the product in different industries and how to use it.

The role of the product in the production chain and the production process helps to determine the HS code. This information shows the role and importance of goods in the production process and industry.

The regulations and guidelines provided by the Regulatory Organization and the Ministry of Industry, Mining and Trade are involved in determining the HS code and tariffs are determined based on them.

By determining the HS code, it is possible to predict which permits and regulations are required for the import or export of this product.

What is the best way to do customs?

If you need consulting services regarding import, export, supply and clearance of various products and goods, you can ask your questions using the direct contact information of Behin Tadbir company at the top or bottom of the website. Also, if the phone lines are busy or the phone is not answered, you can send us a request for advice and your contact number via e-mail or social networks (Telegram, WhatsApp, ITA, etc.) and our experts will respond in less than 24 hours. They will contact you. Please note that before making any in-person referrals, make sure to book an appointment.